Do you want to add more defined benefit (DB) plans to your block of business? The first step is educating yourself on these unique plans. Grow your practice with this helpful education and an easy investment solution to help you meet your investment objectives.

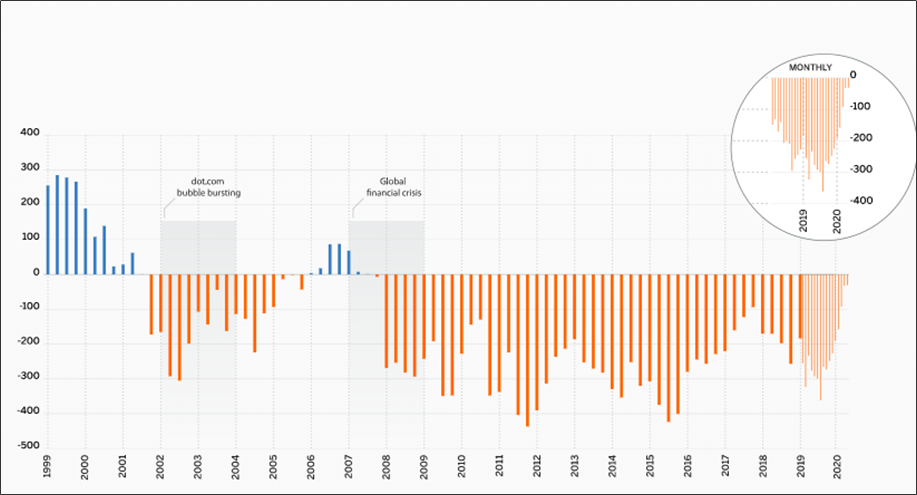

From 2010 to late 2019, the S&P was up 200%, but barely kept pace with the growth a DB plan liabilities. Additionally, discount rates dropped 250 basis points and mortalities tables continue to reflect longer life expectations. Despite a strong decade of market returns, the funding status of many DB plans stayed about the same.

Milliman 100 Pension Funding Index – Pension Surplus/Deficit

The investment allocation of a DB plan, whether a traditional pension plan or cash balance plan, should be set according to the liability and/or objective (e.g., crediting rate in the case of cash balance plans) and a function of the promised benefits. Risk should only be taken to fund the benefit, hence matching the objective with the appropriate risk level/asset allocation model is critical.

To help advisors with DB Plan Reporting, RPAG has developed reporting tools that analyze the allocation, LDI glidepath, and funded status of DB and Cash Balance plans. This new tool within the RPAG Platform helps advisors properly consult to DB and Cash Balance clients.

Here are some helpful resources that RPAG offers for DB and Cash Balance plan consulting: