How re-enrollment boosts positive investment behaviors

The advent of automatic features in DC plans has had a positive impact driving retirement readiness by boosting participation and savings rates, especially among workers newer to the job. 73 percent of large and mega plans use auto-features, such as auto-enrollment and/or auto-escalation, to encourage greater savings in the DC plan.1

Through automatically enrolling new hires to the plan, and directing them to the qualified default investment alternative (QDIA) option, preferably with at least a 6 percent deferral rate to start, employees are not only able to save for retirement but can also do so within an appropriately allocated investment vehicle that matches their specific retirement needs or time horizon.

While most auto-default to the QDIA — whether an off-the-shelf or custom target date fund (TDF), balanced fund or managed account — employees who prefer to allocate and manage their own investments are able to choose from a selection of investment offerings from the plan’s core menu, or opt out of the plan altogether. For plans that implement auto-features, less than one-third of participants opt out, making it a powerful lever for the plan sponsor to effect change in the plan — and for participant outcomes.2

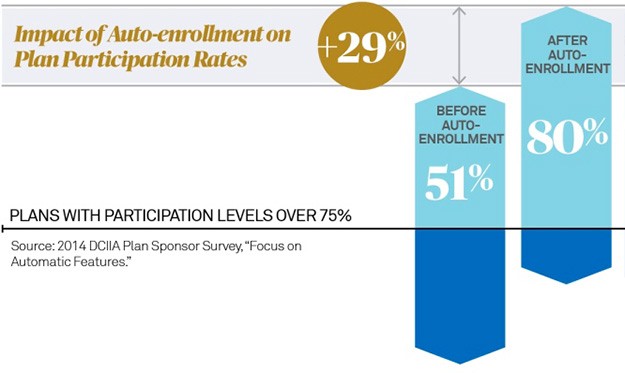

According to the 2014 DCIIA Plan Sponsor Survey3 of 471 plan sponsors across various DC plan types, industries and plan sizes (ranging from mega to small plans) auto-enrollment’s impact on participation is significant.

Separately, in the same study, plans that offer both auto-enrollment and auto-escalation have over twice as many participants with retirement savings rates over 15 percent as plans that do not offer both (14% vs. 6%, respectively).4

The combination of auto-features and other savings incentives (e.g., a matching contribution) chosen by the plan sponsor creates a “choice architecture” for employees’ retirement savings decisions, with increasing behavioral economics literature documenting that these plan design choices can have large effects on savings behavior.5 This in turn leads to an increase in a participant’s probability of success in reaching their optimal income replacement levels in retirement.

While this is promising, it’s becoming clear that two employee segments have been left out of the impact of auto-features, affecting their chance for retirement savings success:

- Active plan participants hired before auto-enrollment and increased auto-deferral rates, resulting in a potentially misallocated investment strategy that may not meet their future needs, a low plan account balance and/or no ongoing contributions.

- Non-participating eligible employees hired prior to auto-enrollment, who chose not to participate in the plan, and are missing out on an impactful retirement savings tool (and potential match) altogether.

A positive nudge from plan sponsors via a plan re-enrollment could make all the difference.

- The Cerulli Report, Retirement Markets 2014, “Sizing Opportunities in Private and Public Retirement Plans.”

- The Cerulli Report, Retirement Markets 2014, “Sizing Opportunities in Private and Public Retirement Plans.”

- 2014 DCIIA Plan Sponsor Survey, “Focus on Automatic Plan Features.”

- 2014 DCIIA Plan Sponsor Survey, “Focus on Automatic Plan Features.”

- Source: Jeffrey R. Brown et al., Individual Account Investment Options and Portfolio Choice: Behavioral Lessons from 401(K) Plans 7 (Nat’l Bureau of Econ. Research, Working Paper No. 13169, 2007) per NYU School of Law, “A Behavioral Contract Theory Perspective on Retirement Savings,” Ryan Bubb, Patrick Corrigan and Patrick L. Warren, July 2015

This is an excerpt of BNY Mellon’s article in Planet DC Magazine, “Reversing Inertia.”

ACR#191796 06/16